The roughly 15-year old experiment called Embedded Linux has by several accounts surpassed real-time OSes and Windows Embedded in recent years. If you include phones, tablets, and consumer electronics using the Linux-based Android, that lead turns to dominance.

The roughly 15-year old experiment called Embedded Linux has by several accounts surpassed real-time OSes and Windows Embedded in recent years. If you include phones, tablets, and consumer electronics using the Linux-based Android, that lead turns to dominance.

This year, Linux has continued to control the fledgling home automation market, and it’s increasingly shaping up as the OS of choice in robots and drones. In consumer electronics, Linux and Android lead in categories such as media streamers and smart TVs. As manufacturers upgrade industrial equipment for wireless Internet of Things capability, Linux has become the OS of choice when an OS is needed at all.

This two-part series looks at embedded Linux trends over the last year in six broad segments, listed roughly in order of market maturity. This installment covers mobile, embedded boards, IoT and home automation. And part two covers media-focused consumer electronics, robots and drones, and emerging technologies like wearables and automotive.

Mobile

In 2015, Android continued to dominate the mobile market. Despite strong competition from Apple’s iPhone 6, Android’s share of the global smartphone market grew 1.4 percent in the third quarter to 84.7 percent, according to Gartner. Yet, the “other” category, principally comprised of a variety of mobile Linux platforms, declined from the previous year from 0.4 to 0.3 percent.

Despite the fact Tizen and Ubuntu Touch finally launched in new phones this year, 2015 was far from being a breakout year for non-Android mobile Linux. It was more like breaking bad.

The most established platform — Firefox OS — was all but shuttered earlier this month. Mozilla will use some of the technology in an upcoming IoT platform, but it won’t be renewing its many carrier contracts in emerging nations around the world.

Firefox OS may yet have life, however. Hong Kong-based Acadine Technologies which was launched by ex-Mozilla execs earlier this year, hopes to pick up those carrier contracts with its own Firefox OS based H5OS distribution.

Another Mozilla spinoff called Silk Road led by Andreas Gal, the principal creator of Firefox OS, probably won’t use any Firefox OS code in its IoT focused platform. Gal told CNET that the main problem with Firefox OS was that it was late to a market dominated by Android and iOS.

If Firefox OS was late with its 2013 launch, Tizen and Ubuntu Touch may have missed the boat entirely with their tardy 2015 debuts. Both offer benefits that should give them a chance, however. Tizen has a solid Linux Foundation hosted mobile distribution, as well as the market power of Samsung and the potential for integration with Samsung smart devices. Canonical’s Ubuntu has a compelling convergence vision and an established base of Ubuntu desktop users to tap into it. Yet, after releasing its first Tizen-based Samsung Z1 phone this summer in India to modest success, the rumored Samsung Z3 has yet to be seen. Several third-party Ubuntu Touch phones have arrived, and since August have been available globally, but the convergence of desktop and mobile OSes continues to be delayed.

Finally, Jolla, which offers the interesting, Meego-based Sailfish OS on its Jolla phone, came close to bankruptcy this year. Last week, the Finnish company announced it was back from the dead with a Series C funding round.

One of the problems with Firefox OS, and to a lesser extent the other platforms, is that people like their apps. To succeed, a mobile Linux project will not only need solid Android compatibility, but also a reason for being that goes beyond not being Google. Time is running out, however, as most mobile Linux developers seem to have defected to IoT. In fact, the mobile platforms have already started morphing into IoT platforms, and there seems to be more interest in Snappy Ubuntu Core, for example, than Ubuntu Touch.

Embedded Boards

The thriving genre of open source hacker boards continues to drive and influence the larger commercial embedded market space and vice versa. Not only are manufacturers opting to use the Raspberry Pi for small-run devices, embedded board vendors are increasingly hosting community-backed SBC projects, or launching open-spec boards of their own.

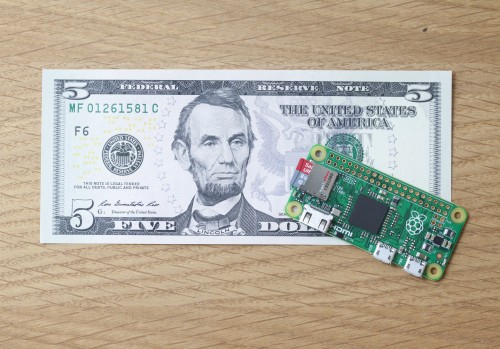

To the dismay of traditional manufacturers, the Pi and its imitators are also forcing immense pricing pressures. Even if new cut-rate hacker SBCs like the $5 Raspberry Pi Zero, or $9 Chip are more typically bought with add-ons that bring the price closer to that of a $35 Raspberry Pi 2, that’s still hundreds less than the price of typical embedded SBCs.

To the dismay of traditional manufacturers, the Pi and its imitators are also forcing immense pricing pressures. Even if new cut-rate hacker SBCs like the $5 Raspberry Pi Zero, or $9 Chip are more typically bought with add-ons that bring the price closer to that of a $35 Raspberry Pi 2, that’s still hundreds less than the price of typical embedded SBCs.

One trend on the rise in both commercial and community camps is the fragmentation of the single board computer into multiple board computers that combine a computer-on-module containing a processor, memory, and increasingly, built-in WiFi and Bluetooth, with a carrier board that provides real-world ports, a power supply, and other extras. In this way, you can upgrade to a faster processor module while maintaining a familiar hardware development platform.

The modularity extends to an increasing number of add-ons. In addition to the many boards that offer Raspberry Pi and/or Arduino shield expansion, we’ve seen a variety of IoT-focused interfaces either for homegrown add-ons or third-party sensor families like Seeed’s Grove modules. This modular approach goes hand-in-hand with a trend toward lower-power IoT boards. The emblematic SBC of the year may be Seeed’s BeagleBone Green remake of the BeagleBone Black, which subtracts the HDMI port and adds Grove expansion.

IoT and home automation

IoT is clearly where the action is in the embedded industry, although defining it is still a challenge. The gist is that you’re aggregating sensor inputs from low-power, typically wireless enabled endpoints via hubs or gateways. In any case, the main two product categories — home automation hubs and industrial IoT gateways — are clearly dominated by embedded Linux.

This year we saw fewer home automation startups and more consolidation and expansion of smart device ecosystems. Alphabet’s Nest has jumped out to take the lead, and it’s now expanding its ecosystem with a Thread-based Weave IoT protocol.

In part, Nest’s success is due to Google’s (and now Alphabet’s) investment and marketing muscle, but it’s also because Nest’s main device is a smart thermostat that can actually save users money. Other home automation applications include cheaper surveillance and security, but much of it is about enabling minor conveniences, or the geeky fun of hacking together a smart home that you can monitor from your smartphone. It remains to be seen how much appeal that will have for the average consumer.

Nest has plenty of competition however, from competitors like Samsung’s SmartThings, and the market is still young. The same can be said of the broader realm of industrial IoT. These more complex systems, are being implemented via gateway computers, but most also provide cloud analytics and reference platforms for endpoints.

So far, the most successful platform for both industrial and consumer IoT is not a company or a product, but a broad standard developed by Qualcomm called AllJoyn. Overseen by the Linux Foundation’s Allseen Alliance, the platform offers vendors a solid foundation for their own IoT platforms, giving them a readymade ecosystem of compatible products. Also of note, Amazon launched an AWS IoT managed cloud platform that depends in part on Linux open-spec SBCs for gateway reference designs.

Another emerging industrial area is 3D printing. Most consumer 3D printers are simple desktop peripherals without much need for embedded Linux, although many are open source. Last year, we saw the first Linux-based 3D printer from MakerBot with its latest, prosumer level Replicators. This year, aside from the tiny iBox Nano resin printer, we have only seen two commercial printers running Linux, and they are both higher end industrial models. Autodesk’s BeagleBone Black based Ember 3D resin printer is now shipping, and the Kickstarter-backed, Pi-based AON will ship in April.

IoT and 3D printing spending is still dwarfed by a larger market in traditional industrial and enterprise embedded devices. Linux continues strong in high-revenue enterprise categories like industrial computers, wireless base-stations, as well as defense and transportation systems.