When new Linux desktop users arrive, the first thing to be done is locate apps to take the place of the ones they left behind. Most often, the bare installation will contain everything you need to get work done. But there are certain app categories that demand you do a bit of searching to get just the right tool.

One such category is personal finance managers. With the Linux platform, you’ll find applications to meet just about every need to keep track of your finances. So if you don’t want to pay the price of QuickBooks Online, you can take control of those records and keep them on your desktop or laptop.

But which apps to use? Doing a quick search, you’ll find a number of entries in the finance space ─ all of which are not created equal. Instead of going into an in-depth analysis of the cream of the crop, I want to highlight three of the personal finance managers that could, in fact, serve you well as you track your earnings, savings, stocks, etc.

1. wxBanker

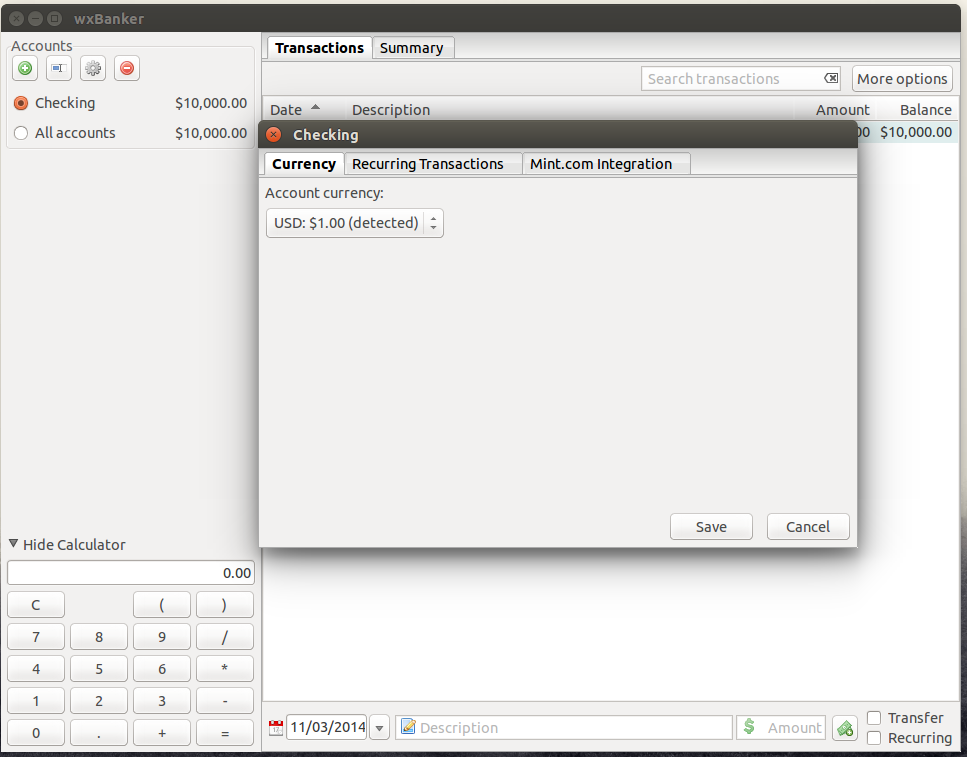

wxBanker is all about simplicity. You won’t find all the bells and whistles many other apps contain. What you will find is an interface that makes it incredibly simple to keep track of your basic personal finances (Figure 1).

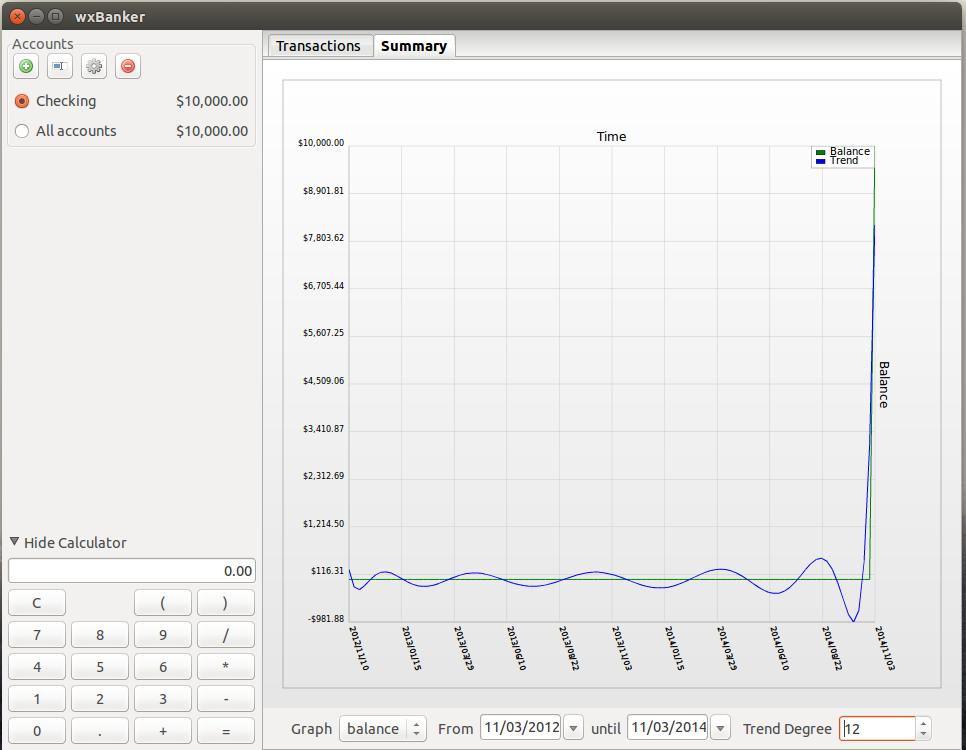

This app does not sync with your online bank records, you won’t do your business books with it, nor will you do your taxes. What it lacks in features, it makes up for absolute simplicity. With wxBanker, you can do simple transactions, transfers, recurring transactions, use a built-in calculator, add as many accounts as you like, enjoy a simple graph, and sync with your Mint.com account (Figure 2).

The wxBanker app is best used as an extended version of your check register that can also keep track of whatever accounts you have connected to Mint.com. What’s best about wxBanker is the lack of learning curve.

2. KMyMoney

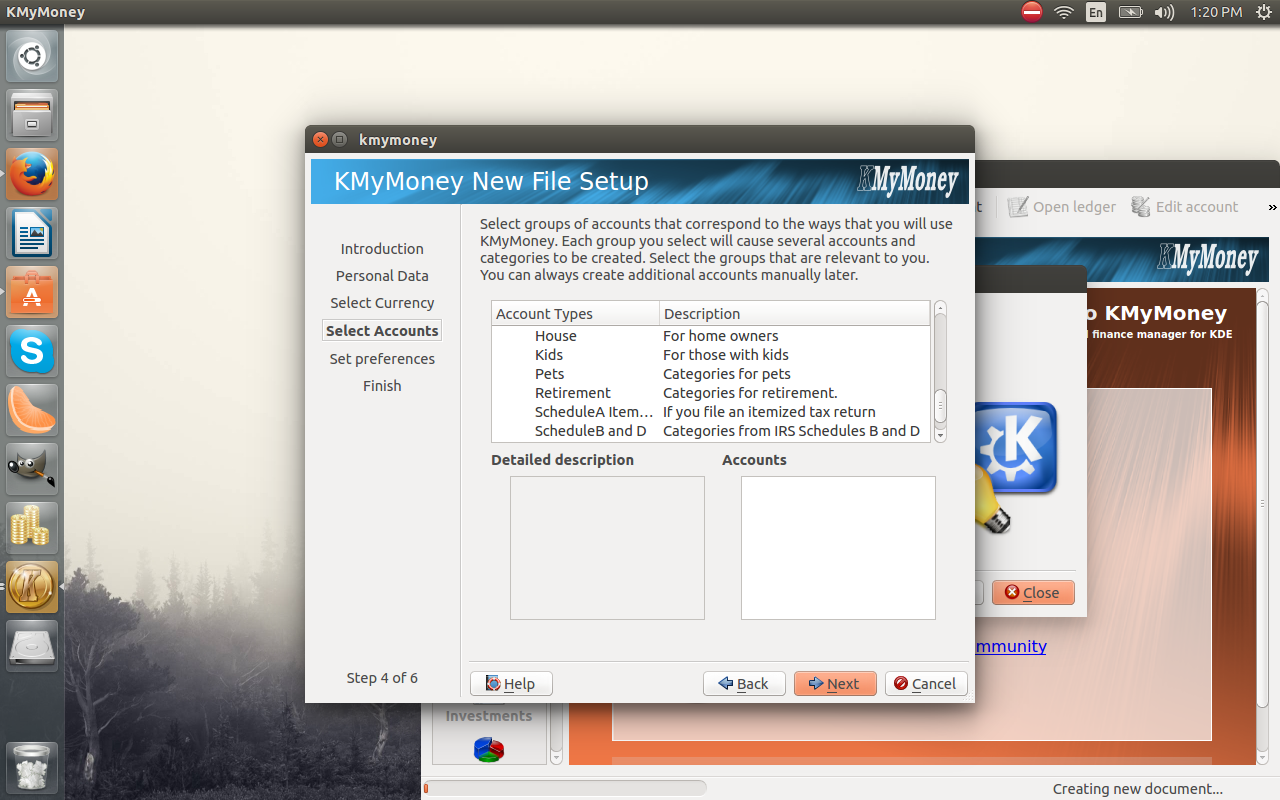

KMyMoney is a native KDE personal finance manager that adds plenty of features to a very well-thought-out interface and makes transitioning from the likes of Quicken or Microsoft Money a no-brainer. KMyMoney features: different account types, categories, QIF import/export, online banking support (via OFX and HBCI protocols), ability to align brokerage and investment accounts, transaction scheduler, and much more. One of the features I find to be a highlight of KMyMoney is the account setup wizard. With just a few steps, you can have an account, specific to your needs, created. Included in that setup is the ability to select account types for specific tax needs (Figure 3).

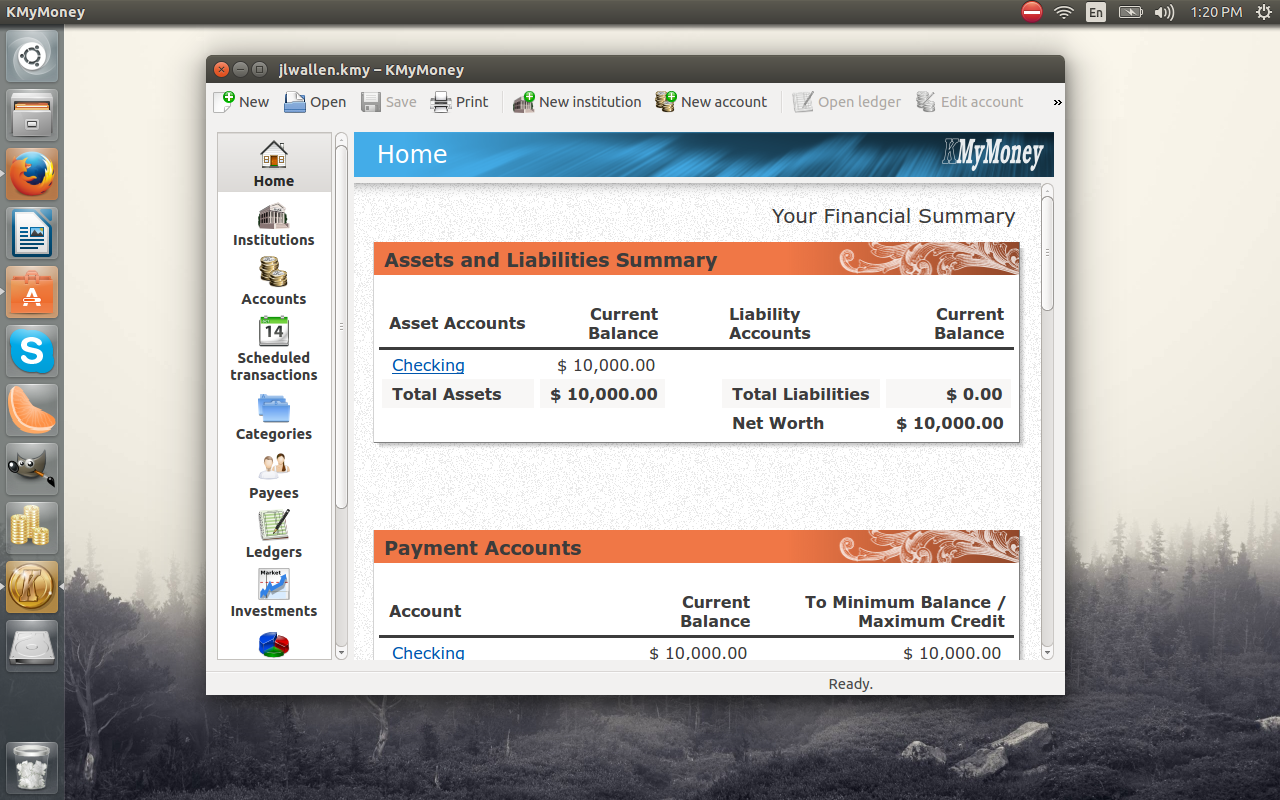

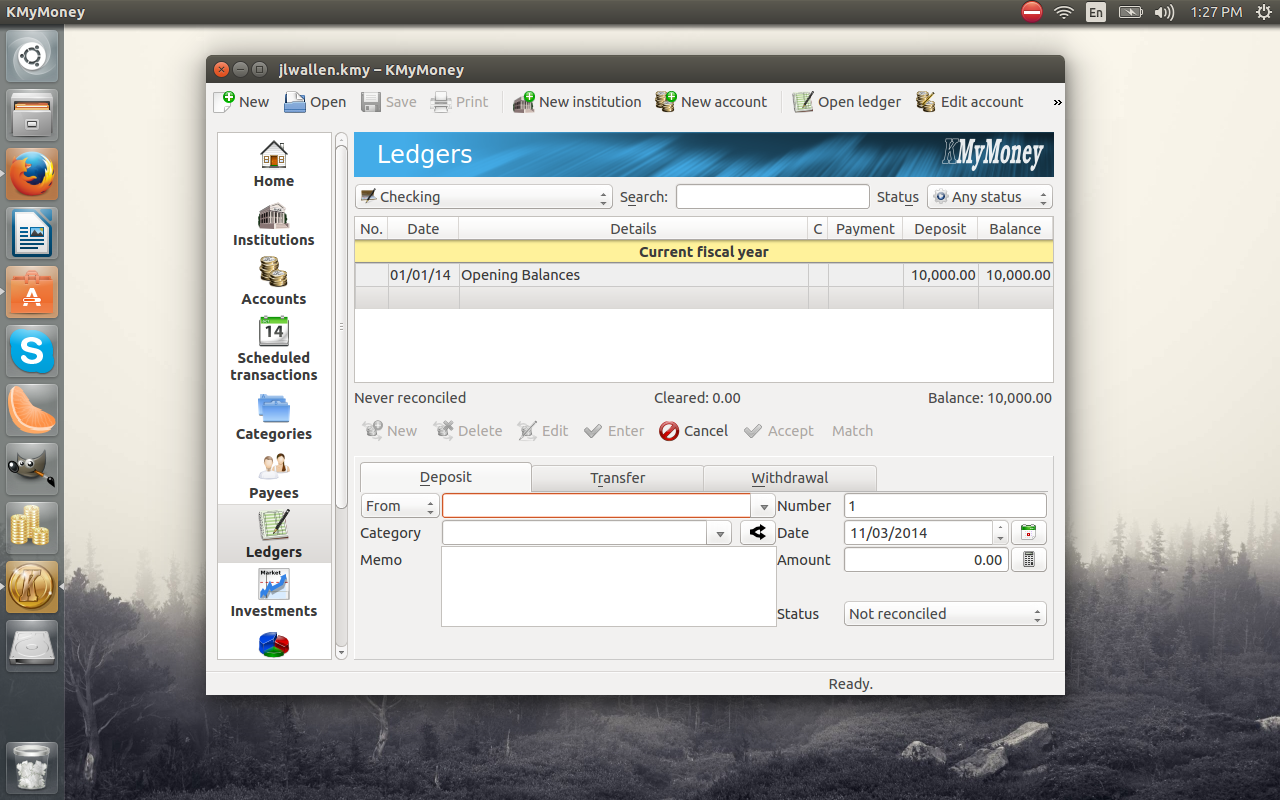

Once the account is set up, you’ll find the KMyMoney interface (Figure 4) incredibly easy to use.

When creating a new transaction in KMyMoney, you have the ability to get more detailed about each transaction (Figure 5). You can set the reconciliation status of the transaction, add memos, and more.

3. GnuCash

GnuCash is often considered the powerhouse financial tool for Linux. Not only does GnuCash do a stellar job of tracking personal finances, it can also serve to keep track of your small business finances. GnuCash is a double-entry accounting package that features:

- Stock/Bond/Mutual Fund Accounts

-

Small-Business Accounting

-

Powerful Reports and Graphs (such as Balance Sheets, Profit & Loss, Portfolio Valuation, and more)

-

QIF/OFX/HBCI Import, Transaction Matching

-

Scheduled Transactions

-

Financial Calculations

-

Enter split transactions

-

Mark transactions as cleared or reconciled

-

Customizable appearance and style.

Already you can see GnuCash takes financial tracking a bit more seriously than the other entries. Although GnuCash offers a lot of business-minded features, it is still an outstanding choice for personal finances.

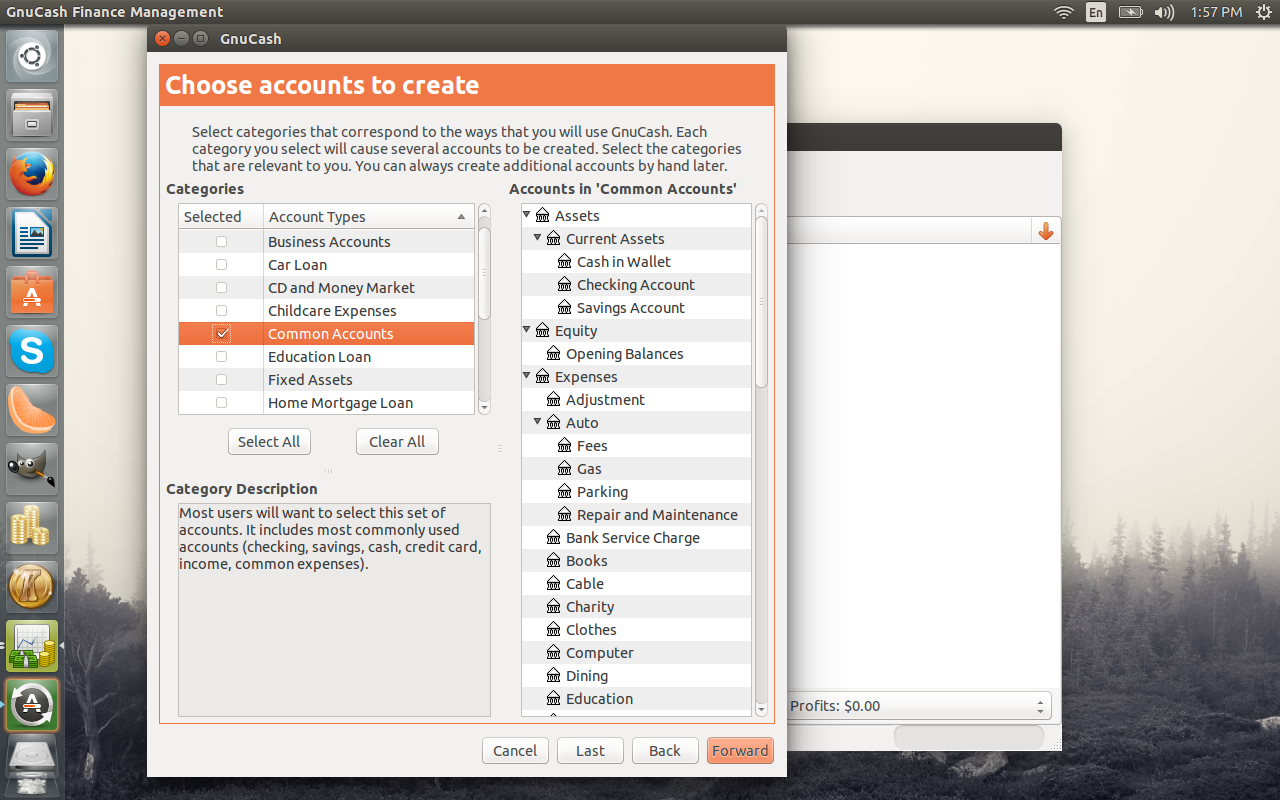

The new account wizard allows you to easily set up a business account and select from a large number of account types (Figure 6).

During the setup, you can even select multiple account types to be included. For example, you can add a collection of common accounts as well as a set of business accounts without having to re-run the wizard.

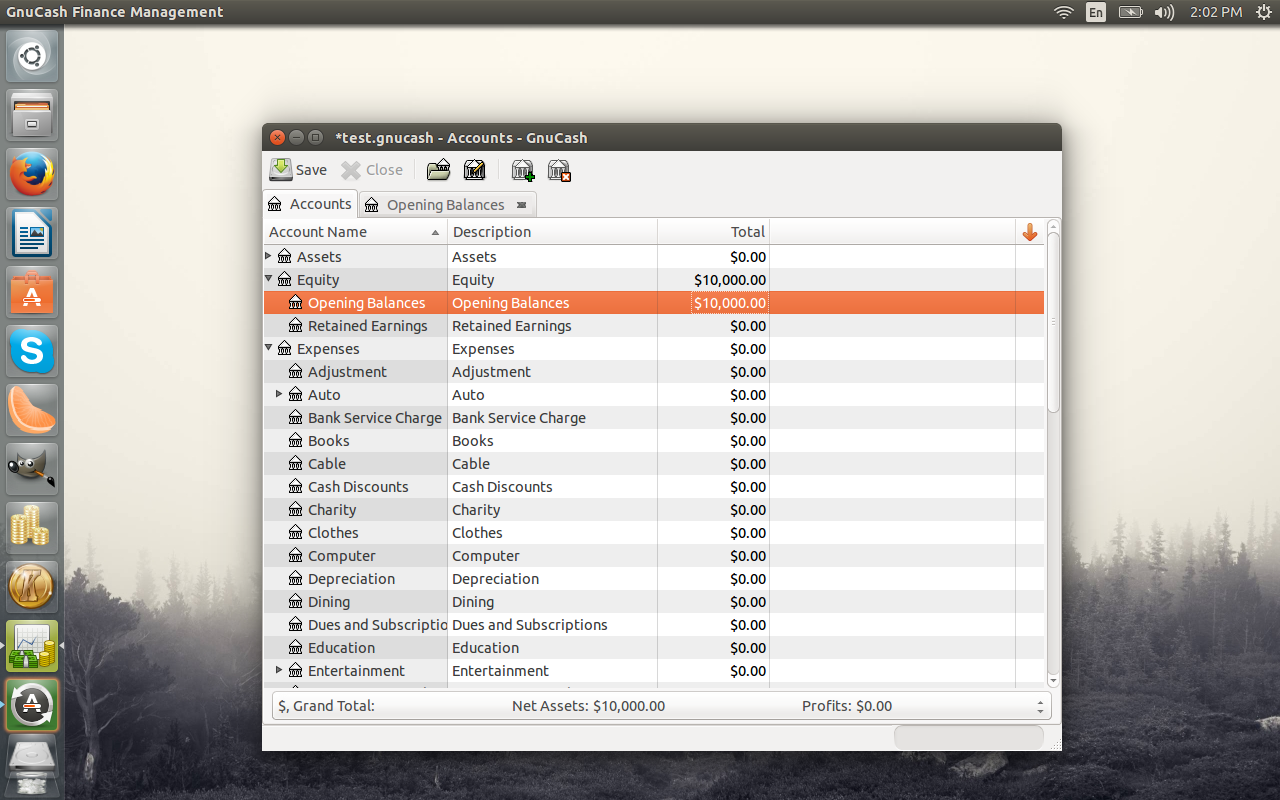

The one caveat with using GnuCash is getting used to the double-entry ledger (Figure 7).

The double entry system is the one barrier of entry for many users. With double entry accounting, every entry to an account requires a corresponding and opposite entry to a different account. For example: Recording earnings of $1000.00 would require making two entries (a debit entry of $1000 to an account called Cash and a credit entry to an account called Income). The good news is that GnuCash does this automatically for you ─ so you don’t have to manually create two entries for every one entry. But understand how double entry works, might help you navigate through your various accounts. This accounting system goes a long way to aid you in year-end accounting (such as with taxes). So if you can acclimate to this new style of bookkeeping, GnuCash will do everything you need in the realm of personal finances … and then some.

If you’re looking for a financial tool that can not only take care of your personal finances, but one day take over as your small business accounting package, GnuCash is exactly what you need.

If you need more help using GnuCash for your small business financial needs, check out this GnuCash getting started guide.

You don’t have to worry that there won’t be a way to track your personal finances, once you migrate to Linux. As with nearly every type of application, Linux has many solutions for every problem. Which financial software is right for you will be a matter of need and taste. And if one of the three listed doesn’t work, there are plenty of other solutions available. Just open up your distribution’s software tool (such as the Ubuntu Software Center, or Synaptic) and search for “financial.” You’ll get plenty of hits to comb through.