Author: Dmitri Popov

Although the idea of using an application to manage your personal finances makes a lot of sense, not all of us have the time and patience to learn all the intricacies of tools like GnuCash or Money Manager Ex. If that sounds like you, try Buddi, probably the easiest to use personal finance manager out there.

Written in Java, Buddi runs on most platforms that can run the Java Runtime Environment. If you are running Debian or Ubuntu, you can download and install it from a .deb package; otherwise you can opt for a plain .jar file that will run on pretty much any Linux distro.

To launch Buddi, use the java -jar Buddi-x.x.x.x.jar command. When the application is up and running, it immediately prompts you to create a new data file. There are two things you should keep in mind here. First, it’s a good idea to place the data file in a separate directory, so when Buddi generates reports and graphs they are neatly stored in the same location as the main file. More importantly, you should encrypt your data file to make sure that nobody else can access your financial information.

After you’ve created the data file, you are dropped into Buddi’s main window, which has four tabs: My Accounts, My Budget, Reports, and Graphs. Before you start using the program, though, it’s worth spending a few minutes configuring its settings. For example, Buddi uses American dollars as the default currency, so you might want to change that if you are not in the US. To do this, choose Edit -> Preferences, click on the Locale tab, press the Other button next to the Currency Format field, and select the desired currency. You can change the default date format as well by pressing the Other button next to the Date Format field. When you are satisfied with the settings, press OK to save them and return to the main window.

Now you can populate the My Accounts section with accounts. Press the New button, give the account a name, and choose its type from the Account Type drop-down list. Buddi operates with two account types: credit (accounts to which you owe money) and debit (accounts in which you have money). For example, cash and checking accounts belong to the debit type, while credit card and loan accounts fall into the credit category. If the account type you need is not on the list, you can easily add it — choose Edit -> Preferences, click on the Advanced tab, press the Edit Account Types and add the type you need — such as investment, asset, and liability types. Lastly, enter the initial balance into the Starting Balance field, press OK, and your account is ready.

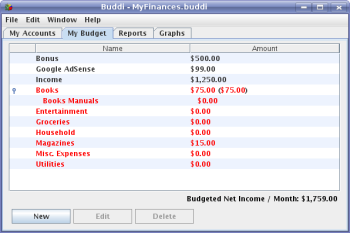

Next, you should edit the default budget to reflect your actual income sources and expenses. Switch to the My Budget section, delete the entries you don’t need (like investment expenses and auto if you don’t have either of them), and add the categories you want. Here you can also specify subcategories, which allow you to keep better track of your expenses. For example, you could create a category called Entertainment that contained several subcategories like Movies, Theatre, Videos, etc. Later, you can see not only how much you spend on entertainment in general by also on each specific type.

Now you’re ready to start adding transactions. A transaction is just a record of what you’ve spent money on, and which account you’ve used to “finance” your purchase. For example, if you bought a magazine at your local newsstand and you paid for it from your pocket, the transaction would be from your Wallet account to the Magazines budget category.

To manage transactions, double-click on the account you want to use. That opens the Transactions window, which contains a list of all recorded transactions for the current account. If no record is selected, you can create a new transaction by filling out the fields at the bottom of the window (at the very least, you have to provide the date, amount, and sources). Alternatively you can press the New button. Press Record to save a transaction. To modify any existing transaction, select and edit it, then press the Update button.

Buddi also supports so-called scheduled transactions, which can come in handy when you want to make payments that occur on a regular basis — donations, club membership payments, house rent, and so forth. To create a scheduled transaction, choose Edit -> Edit Scheduled Transactions in the main window. The only difference between a regular and scheduled transaction is that the latter occurs on a specified date, so you have to add a payment schedule for it. Once you’ve done that, Buddi will automatically add a record to the transaction list each time the scheduled transaction occurs.

That’s pretty much all Buddi’s features. Since the application tries to keep it simple, it lacks more advanced features like the ability to print checks, connect to online institutions, or track investments. If that’s what you are looking for, Buddi isn’t the right choice for you.

Reports, graphs, and plugins

To make sense of all the entered data, Buddi provides both reports and graphs. You can easily generate reports of your income and expenses for a certain period of time and grouped by Category or Description. Just choose a time period from the appropriate drop-down list in the Reports section. While you can’t customize the default reports, they provide more information than you’ll probably ever need. The only caveat here is that Buddi generates reports in the HTML format and displays them in the browser. A built-in feature with a printing option would have been a better solution.

If plain tables full of data don’t tickle your fancy, try Buddi’s graphs to help you to visualize your financial data. As with reports, you only have to select a desired time period from the appropriate drop-down list, and Buddi takes care of the rest.

Finally, you can extend Buddi’s functionality by installing plugins. While the current list of available plugins is short, there are a few useful ones among them. For example, if you need to exchange financial data with other applications, you’ll appreciate the plugin that can import and export data in the CSV and QIF formats.

To install a plugin, download it from Buddi’s Web site and unpack it. In Buddi, choose Preferences, click on the Plugins tab, press the Add button, and select the unpacked .jar file. Restart Buddi, and the plugin should be ready for use under the appropriate menu. If you’ve installed, for example, the ExportQIF plugin, it appears under the File -> Export menu.

Buddi is not the most flexible or powerful personal finance manager out there, but it may be exactly what you need if you want to manage your personal finances with minimum fuss.

Categories:

- Reviews

- Desktop Software