A new VDC Research study projects that Linux and Android will continue to increase embedded market share through 2017 while Windows and commercial real-time operating systems (RTOSes) will lose ground. The study suggests that the fast growth of IoT is accelerating the move toward open source Linux.

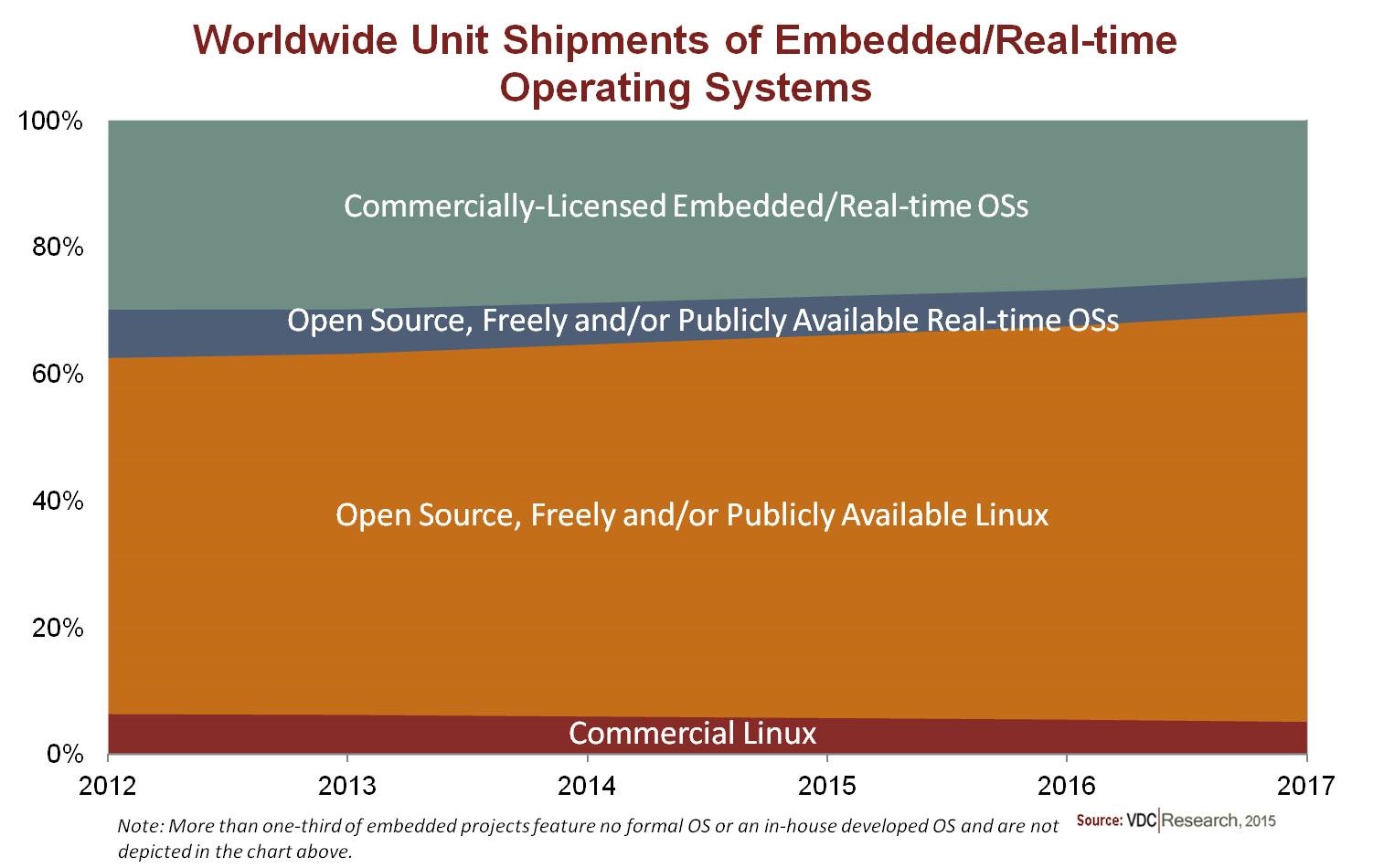

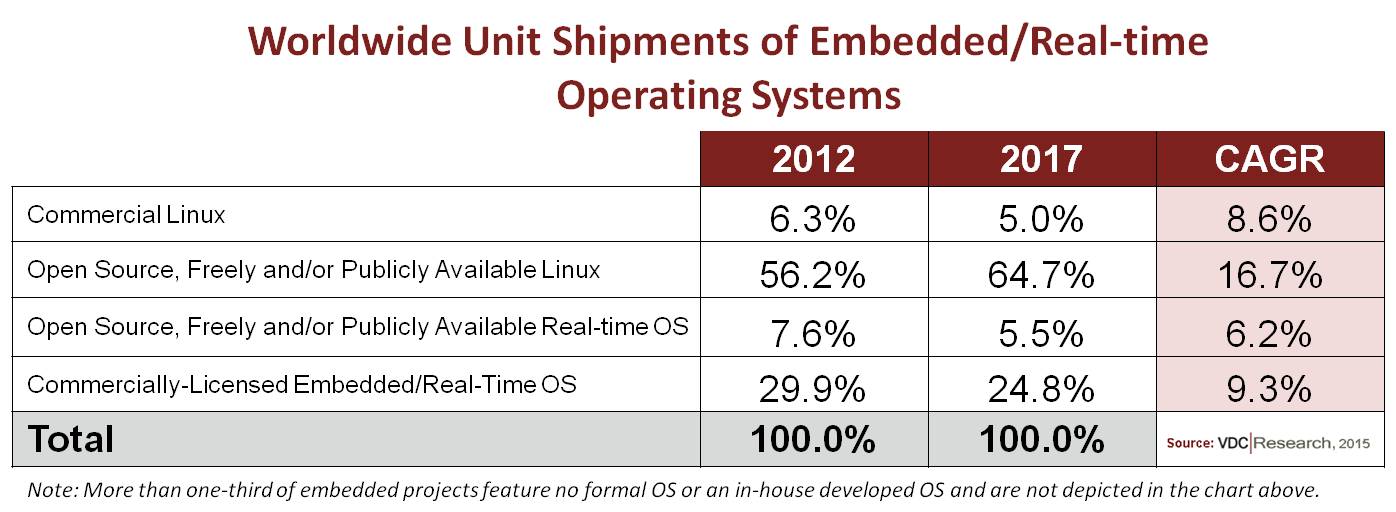

“Open source, freely, and/or publicly available” Linux will grow from 56.2 percent share of embedded unit shipments in 2012 to 64.7 percent in 2017, according to VDC’s “The Global Market for IoT and Embedded Operating Systems.” That represents a CAGR of 16.7 percent for open Linux, says VDC.

The surging open source Linux growth more than compensates for the decline from 6.3 percent to 5.0 percent in commercial Linux shipments. In 2013, there were more than 1.7 times more shipments of embedded devices based on open source OSes, including free RTOSes, than for commercial platforms, says VDC.

“Linux, in particular, continues to grow its developer base and support from leading vendors,” says Daniel Mandell, an analyst at VDC Research. “Linux is the primary OS for new connected device classes such as IoT gateways.”

Note that revenues from commercial distributions are higher, relatively speaking, than unit share. Microsoft, with its Windows Embedded, and Intel’s Wind River, which leads the commercial Linux market with Wind River Linux and also offers the VxWorks RTOS, together accounted for more than half of embedded revenues in 2013, says VDC. In addition, the entire embedded/IoT market is growing, so market share declines don’t necessarily suggest business declines.

The charts above and below do not include shipments of devices running the Linux-based Android. This segment is dominated by consumer smartphones and tablets, more than 600 million of which shipped in 2013, says VDC. While overall Android shipment share will start to decline slightly in 2017 due to saturation in the mobile consumer device market, VDC projects general embedded products running Android will gain share over the next few years. Over the last three years, Android shipments that did not include smartphones, tablets, and E-readers grew at a CAGR of 149.2 percent, culminating in about 15 million units shipped in 2014, says VDC.

In the general embedded market Android is eating into the share of Windows Embedded more than that of Linux, says VDC. Android is moving quickly into areas where Windows has generally outperformed Linux, including automotive infotainment, medical devices, military handhelds, and to a lesser extent, retail and signage.

While some of these applications can be considered IoT, Android is not doing as well in applications that are more typically labeled IoT, such as connected home and industrial automation. These are areas where Linux will continue to shine. Even Google’s Nest, for example, runs Linux rather than Android.

Windows 10 tips hat to IoT

Microsoft’s embedded future will depend in large part on how Windows 10 fares in the embedded market beyond desktops. This week, the company revealed that Windows 10 will have a 6.6 GB smaller footprint than Windows 8, and will be available in a free, maker-oriented version designed for the Internet of Things. This Windows for Devices/IoT, or Windows 10 IoT, will not only run on the Raspberry Pi 2, but also two other open Linux boards: Intel’s MinnowBoard Max (Intel Atom) and the Qualcomm Dragonboard 410c (Snapdragon 410).

Windows 10 IoT is intended to replace Windows Embedded/CE, which only a decade ago dominated Linux in embedded along with its forgotten cousin Windows Mobile. Windows Embedded still owns a big chunk of the industrial, retail automation, and medical devices market, and drives 95 percent of the world’s ATMs. Yet, the proprietary nature of the aging platform has limited appeal among embedded developers.

Now Microsoft is trying to woo them with a free, if not fully open, platform better suited to IoT. “Microsoft’s efforts to support open development boards and the maker community should propel Windows in embedded and IoT applications,” says Mandell.

Open RTOSes supersede No-OS projects

The VDC figures do not include devices with a custom-built, in-house OS or no OS at all. This segment, which represents over a third of embedded projects, is the only real loser in the IoT era, suggests VDC. In recent years, open source and/or free RTOSes — particularly FreeRTOS — have expanded quickly, primarily in microcontroller unit (MCU) based devices that previously had no formal OS.

“The growth in open source RTOSes has been propelled by the need for an RTOS itself,” says Mandell.

The reason: IoT is demanding more from MCU-oriented devices. IoT nodes such as industrial sensor gear typically require wireless support, and perhaps a bit of security code. Firmware for such functions is difficult to build from scratch without an OS.

“The acceleration in computational, networking, and interface requirements on embedded devices is increasing the need for formal OSes,” says Christopher Rommel, VDC Executive Vice President. “It is likewise making the further development and maintenance of internal OSes often infeasible and/or cost prohibitive.”

Why then do VDC’s projections show unit share for open RTOSes declining? It turns out that the same IoT-driven complexity that has fueled open RTOSes is now driving growth in more sophisticated IoT devices that require more advanced OSes like Linux. This is particularly true of IoT gateways, which aggregate information from largely MCU-driven endpoints.

According to Rommel, the surge in open RTOSs “has caused sufficient disruption to make the pendulum swing back toward commercial options.” Rommel notes that commercial OS vendors have aggressively pursued the IoT market while releasing smaller footprint SKUs like the upcoming Windows 10 IoT or Wind River’s new VxWorks microkernel. Meanwhile, commercial RTOS vendors have lowered prices.

Why IoT likes open source

The growth of the Internet of Things is accelerating the ongoing trend toward open source, says Mandell. Open-spec SBCs like the Raspberry Pi, BeagleBone, and Arduino, are well suited for developing IoT endpoints, and the heterogeneous nature of the IoT, which demands integration with multiple third parties, aligns itself nicely with open platforms.

“Community-backed development platforms are playing an instrumental role in IoT prototyping and development,” he adds.

Yet, the IoT role for Linux will be limited by the degree to which it can control MCUs. While the barebone, Linux-derived uClinux can run on some MCUs (usually badly), microcontrollers are typically beyond the reach even of lightweight Linux distros like OpenWRT, which is popular in MIPS-based IoT devices. MCUs are beyond the scope of the more resource demanding Android and Windows. No wonder ARM decided to launch its own IoT-oriented Mbed RTOS for its Cortex-M MCUs.

“Linux is seeing broad use among IoT gateways, but the majority of node devices connecting to them will feature Cortex-M or Cortex-R processors,” says Mandell. Intel, meanwhile, is trying to push its Linux- and RTOS-supported Quark processor in the same market, he adds.

IoT gateways raise ante for embedded

IoT applications that will “really gain traction in the next few years” include connected industrial/manufacturing, remote health monitoring, automotive infotainment, and wearables, says Mandell. Home automation is another growth area, although Mandell sees this “extremely competitive” market as representing a smaller portion of the IoT pie.

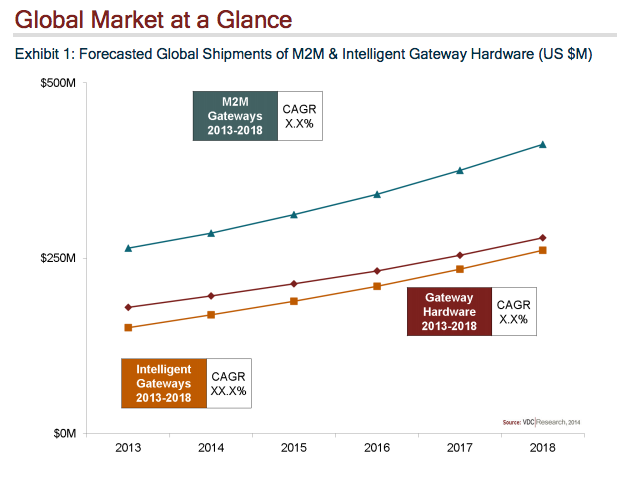

Sensor-driven industrial IoT devices are increasingly connecting with IoT gateways, which aggregate node data and communicate with cloud services. This trend will later expand to home automation.

“IoT gateways are being increasingly deployed in environments like automotive/fleet, energy, and industrial or smart floor applications,” says Mandell.

IoT gateways are also enabling “new connected industry solutions and services,” says Mandell. “They typically reside in the cloud, where the vendor can enable stickier, subscription-based revenues, but they can also exist natively on an intermediary device. The growth of IoT solutions will be restricted, though, by long product lifecycles and the lack of engineer expertise in wireless.”

IoT gateways are also enabling “new connected industry solutions and services,” says Mandell. “They typically reside in the cloud, where the vendor can enable stickier, subscription-based revenues, but they can also exist natively on an intermediary device. The growth of IoT solutions will be restricted, though, by long product lifecycles and the lack of engineer expertise in wireless.”

With IoT gateways and other complex devices such as automotive computers, embedded providers must now furnish more of the software stack in addition to supplying or supporting a variety of development tools and environments, says VDC. Examples include aggregating IoT data, security and communications frameworks, and virtualization.

This embedded middleware trend primarily plays to the strength of commercial OS vendors, helping to mitigate their declining share of unit shipments. Wind River has made a major push in Linux-based IoT gateways, and Microsoft has added IoT services to its Azure cloud platform, notes Mandell.

Open source IoT frameworks are also developing middleware. VDC points to DeviceHive and Qualcomm’s AllJoyn as early leaders here. In addition, “Eclipse has seen considerable traction with IoT,” says Mandell, noting that the membership of the IoT Eclipse group includes leading IoT vendors like Cisco, Eurotech, and Sierra Wireless.

Security and communications are priorities in IoT gateways and other advanced gear. Virtualization, which is used in under 20 percent of embedded projects, will be next on the radar. Key virtualization applications include secure, multicore systems, primarily in military/aerospace, industrial, and medical systems, as well as Network Functions Virtualization (NFV) in telecom, says Mandell.

Virtualization can also enable multi-OS implementations combining GUI-ready OSes like Linux with RTOSes. “Increasingly MCUs running open RTOSes are being used as secondary or tertiary OSes within more complex IoT devices, often for node and measurement tracking,” says Mandell. Devices with multiple OSes represented 22.6 percent of embedded projects in 2013, rising to 25.6 percent in 2014, says VDC.

Linux often plays a role in such heterogeneous designs, either via virtualization or hybrid SoCs. Xilinx and Altera started the hybrid trend with the Zynq and Cyclone V, respectively, both of which offer on-chip programmable fabric that spans Cortex-A9 cores running Linux and FPGAs running custom code. These hybrid SoCs partially open up difficult to program FPGA capabilities to mainstream developers.

Freescale has done something similar, except with MCUs. Like its earlier Cortex-A5/Cortex-M4 Vybrid SoC, which runs Linux and the MQX RTOS, respectively, its new Cortex-A9/M4 i.MX6 SoloX goes even farther in coordinating the two processors and OSes.

The coming merger of NXP and Freescale is aimed at part in developing hybrid strategies that combine Linux-friendly processors with MCUs. The combined company will rank second after Renesas in MCU share (2013) with 17.1 percent compared to 25 percent, says VDC. The ability to span these worlds are particularly important in IoT and automotive deployments.

More information on “The Global Market for IoT and Embedded Operating Systems” may be found at VDC Research.