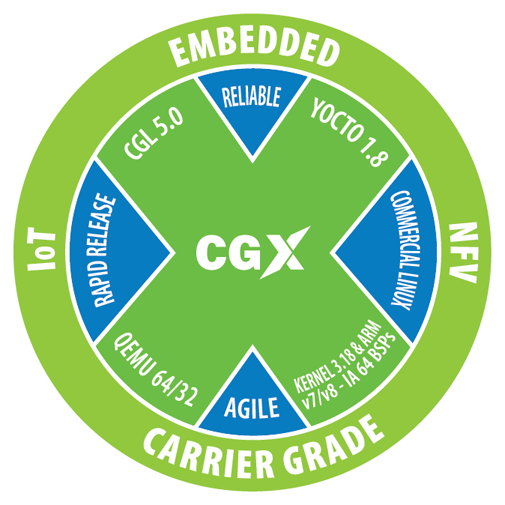

MontaVista Software has launched an Internet of Things version of its commercial MontaVista Linux Carrier Grade Edition (CGE) development platform. The new Yocto Linux-based MontaVista Linux Carrier Grade eXpress (CGX) distribution will be available in the fourth quarter in a scaled down CGX Foundation optimized for IoT products. Customers can then add profiles including Carrier Grade and Virtualization in modular fashion.

MontaVista Software has launched an Internet of Things version of its commercial MontaVista Linux Carrier Grade Edition (CGE) development platform. The new Yocto Linux-based MontaVista Linux Carrier Grade eXpress (CGX) distribution will be available in the fourth quarter in a scaled down CGX Foundation optimized for IoT products. Customers can then add profiles including Carrier Grade and Virtualization in modular fashion.

MontaVista Linux CGX differs from MontaVista Linux CGE not only with its smaller footprint and modular approach, but with a yearly release cadence that aims to keep projects up-to-date with the latest IoT technologies. CGX provides real-time, power management, memory footprint optimization, and connectivity features, while also adding a few features missing from CGE, including a built-in QEMU simulator and Docker container support.

Like rival Wind River, which years ago took over Cavium-owned MontaVista’s leading role as the top commercial embedded Linux software vendor, MontaVista is aiming primarily at the IoT gateway market. Wind River, for example, makes the Linux-based Edge Management System software for the Intel Atom and Quark-compatible Intel IoT Platform for gateways.

IoT gateways, which aggregate input from endpoints such as sensor devices, require a unique mix of embedded and wireless technology, networking savvy, and cloud integration. In MontaVista’s scheme, you can drive simpler gateways with CGX Foundation while using the same software with Carrier Grade Linux profile for more advanced gateway systems farther up the food chain.

In a sense, IoT gateways bring technology full circle. Internet of Things typically refers to lower end, albeit wirelessly enabled, embedded endpoint equipment, overlapping in some cases with RTOS/microcontroller based endpoint devices. Yet, IoT gateways also require integration with high-end networking as well as enterprise server and cloud resources. In addition, IoT gateways require a higher end, networking savvy OS like Linux.

Scores of companies are going after the IoT gateway market from various angles. These include Intel, Qualcomm with its AllJoyn/AllSeen standard, Samsung with its Artik modules, and Canonical with its Snappy version of Ubuntu Core. The lightweight Snappy, for example, works much the same in an embedded device or a Docker virtual container running on a cloud server.

Many more enterprise and cloud companies are looking into the market at the same time that embedded hardware firms and projects tackle the segment from the ground up. The emerging IoT gateway market brings together some strange bedfellows indeed, often speaking in mutually incomprehensible jargon. This is all the more reason to have enterprise, cloud, and embedded events mixed together, as the Linux Foundation has done with recent conferences, like the upcoming LinuxCon + CloudOpen + Embedded Linux Conference Europe. The LinuxCon Europe show, which runs from Oct. 5-7 in Dublin, Ireland, prominently features IoT in several of the shared keynotes.

MontaVista aims to stay relevant in a business it helped invent

It’s nice to hear MontaVista Software is keeping current with the latest IoT developments. We no longer hear much from the company, which still owns a good chunk of the high-end Carrier Grade Linux market with CGE, but has otherwise largely faded from view. The Cavium subsidiary dropped the mainstream MontaVista Linux distribution for consumer electronics, and it sold its GENIVI-compliant automotive stack to Mentor Graphics in 2013.

Long before it was acquired by networking chipmaker Cavium, MontaVista Software was the primary driver of embedded Linux. Jim Ready launched MontaVista in 1999 with the first fully formed embedded version of Linux, called Hard Hat Linux. Today, commercial Linux distributions like MontaVista, Wind River, Mentor Graphics, and Enea Linux are somewhat peripheral to the heart of embedded Linux development, although they collectively run a large percentage of high-end embedded industrial and networking systems around the world. The industry is now driven more by chipmakers, hacker communities, standards groups, Google’s Android ecosystem, and open source code sets like Linaro and Yocto, which now underlies all the major commercial distros.

Embedded Linux vendors like MontaVista and Wind River, which expanded from its VxWorks RTOS business to launch Wind River Linux in 2004, were essential to building the case for Linux vs. the dominant RTOS, Windows CE, and Windows Mobile platforms of the time. In the early years of the 21st Century, semiconductor companies had only begun to release Linux distributions optimized for their embedded processors. There was no Yocto or Linaro, and few open source embedded hacker communities. Desktop Linux distros had limited embedded or mobile support, and usually only for x86, and something like Android had not even been imagined, let alone planned.

By 2003, Hard Hat Linux had become MontaVista Linux, and had moved beyond industrial and networking equipment to target early Motorola smartphones. Years before the iPhone and subsequent Android and BlackBerry phones turned the smartphone into a must-have consumer device, companies like Motorola and Panasonic launched a variety of Linux smartphones. One of the first major open source hardware projects — OpenMoko— was a smartphone platform instead of an SBC.

Linux phones, and later, the small, thick tablets called MIDs, never took off much beyond certain Asian markets. Yet, Linux increasingly thrived in industrial, networking, defense, and consumer electronics segments, where it appeared in early successes like the TiVo and Roku set-tops. For a time, Linux even thrived in netbooks, which included products that ran a MontaVista version of Moblin, the forerunner of Meego.

MontaVista ain’t what it used to be, but we wish it well in the turbulent currents of embedded Linux. The industry wouldn’t be quite the same without it.