Author: Joe Barr

I felt bad for Linux vendors after reading Peter Galli’s eWeek article, which claims that Linux server sales on X86 hardware have run into a stone wall, going from a 53 percent growth rate to four percent decline over the past six quarters — until I did a little research that easily refuted that claim.

Galli cited the IDC Quarterly Server Tracker (QST) as the source of the figures. While looking for that report on the IDC site, I found one from August which states that “Linux servers posted the fifth consecutive quarter of accelerating revenue growth, with year-over-year revenue growth of 19.0%, for a total of $1.8 billion in the quarter. Linux servers now represent 13.6% of all server revenue, up from 12.1% a year ago.”

Encouraged to find that the sky was not falling after all, I kept looking for Galli’s QST, but had no luck. Evidently, it is available only by subscription. I requested a copy of the survey from IDC press relations on the company’s Web site, and followed up the next day by telephone. I didn’t receive a copy of the the QST, but IDC’s Mike Shirer did tell me that “Galli hacked that article pretty badly.”

Then I noted that Galli cited Bill Hilf of Microsoft — probably the single least trustworthy person on the planet to ask about Linux, except, perhaps, for Microsoft CEO Steve Ballmer himself. Given Microsoft as a primary source, and IDC’s assertion that Galli “hacked” the article, it dawned on me that the whole thing might be bogus, that maybe Linux servers are not losing market share after all.

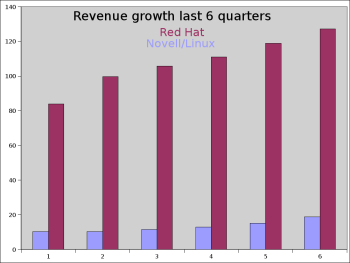

I decided to do a little research of my own. I looked at the revenue figures over the last six quarters for Red Hat, the most successful commercial Linux operation, and for Novell’s revenues based on its Linux platform. Amazingly, those graphs show Linux server revenues from the top two commercial offerings of the FOSS platform have increased, not declined. Both are hitting record highs, quarter after quarter after quarter.

Did IDC go wrong in the QST? It’s pretty hard to tell when you can’t see the survey. In fact, it seems likely that it is Galli who is erring on the issue, rather than IDC. But if IDC is counting preloads at the factory, it is using meaningless data about Linux versus Windows in the real world. Red Hat and Novell both get the overwhelming bulk of their (Linux-related) revenue from subscriptions for support of their server software.

In Red Hat’s most recent quarter, for example, total revenues were $127.2 million, and 85% of that came from subscriptions. Measuring server preloads would not reflect market size, strength, or vitality. Apparently that’s tough for some people to understand. I’ve written before about the difficulties inherent in measuring open source usage.

I admit I see a lot of irony in the computer trade press, especially with so many sources eager to discount the phenomenal growth of Linux the past few years by saying, “Oh, well, it’s natural. All the low-hanging fruit is gone now, and the day of reckoning has come.”

Where have these pundits been the past 20 years? It’s about that long ago that Microsoft announced it was the Unix killer, and that all of the Unix market share would be Microsoft’s. If Linux really is doing a better job of winning over Unix boxes than Microsoft is, or if it is being installed on more Unix than Windows boxes, it doesn’t matter. Linux is still taking boxes that Microsoft had targeted, staked out, and claimed for itself. The real story here is that Microsoft has lost servers it claimed it would win, boxes it wanted to win. Instead, Linux has taken them. Enough is enough.

I’m reminded of a survey that made the rounds a couple of years ago. It was done by a Canadian research group called Info-Tech and paid for after the fact by Microsoft, and it claimed that small business was losing interest in Linux. Microsoft wanted so desperately for customers to buy into that tale that it plastered the survey results on its Web site.

That was two years ago. Red Hat reported revenues of $57.5 million for the quarter ending February 28, 2005. For the same quarter this year, Red Hat revenues were $111.1 million, an increase of more than 93%. Not bad for a firm which business has lost interest in, eh? By the way, comparing the quarter ending December 31, 2004, and the same quarter two years later, in 2006, Microsoft’s revenue increased only 18 percent. I guess that company can’t find even the low-hanging stuff.

The bottom line is that Linux continues to thrive, and Microsoft — well, Microsoft continues to do what it does best. Linux improves and grows its user base day-in and day-out, and Microsoft dishes out deceptions. Note to Galli, Peter Judge, Stan Beer, and all the other pundits echoing the meme that Linux is losing: based on the facts — which show 93% growth for Red Hat versus 18% for Microsoft over the past two years — if any company is getting close to hitting the wall, it’s not a Linux vendor.

Categories:

- Commentary

- Linux

- Business